|  | | Saturday, February 01, 2020 • By Walter Thompson | |

| | | The best advice is born from experience, which is why failure and disappointment are just as instructive as success. This week, we ran posts by investors and entrepreneurs who shared what they learned in good times and bad: Ann Miura-Ko, co-founding partner of seed-stage VC firm Floodgate, looked back at what she’s learned over the last 11 years. “When I reflect on the failures, the root cause inevitably stems from misconceptions around the nature of product-market fit,” she concluded. “Before attempting to scale your minimum viable product, focus on cultivating your minimum viable company.” Volition Capital’s Roger Hurwitz says “debt can serve as a valuable piece of a company's capital structure,” adding, “the key is to use debt for the right purposes and to understand the implications of doing so.” We also spoke to five VCs to find out where they’re seeing opportunities in travel and tourism, investor Crystal McKellar wrote about how her career as a child actor made her a better VC and we covered Bykea, a three-year-old ride-hailing and delivery service in Pakistan that’s beating Uber — even though it’s received less than $7M in funding. A preview of the week ahead: high-level coverage of Africa and Europe, part two of our freewheeling interview with Justin Kan and the next edition of “Dear Sophie,” our immigration law advice column. Thanks for reading Extra Crunch! Read more | | | |

| |  Image Credits: Ford | | "We've gone from the scrappy upstart, the guy who was least-funded, the guys who kept to their principles and always deployed working with cities, who realized that there would be a chance for a long-term kind of business here," Spin co-founder Euwyn Poon told TechCrunch. "Now, through the Ford acquisition, we can take an even longer-term view." Read more | | | |

| |  Image Credits: ovo Marjanovic/EyeEm / Getty Images | | It's a rare founder who wants to go from zero to running and scaling a large, long-term company, but when that time comes, you may have expectations about what you would like to exit for. But what are investors looking for? Ed Byrne, co-founder of Scaleworks, shared five criteria with Extra Crunch he uses when evaluating new opportunities. Read more | | | |

| |  Image Credits: Virojt Changyencham / Getty Images | | “In my experience, debt can serve as a valuable piece of a company's capital structure. The key is to use debt for the right purposes and to understand the implications of doing so,” says Roger Hurwitz, a founding partner at Volition Capital. Read more | | | |

| |  Image Credits: NFL/AWS | | Sports fans have always sought statistics about how their favorite teams and players are performing. Until recently, the numbers were generated from basic counting, like batting averages, home runs or touchdowns. Today, leagues are looking to learn more about players and find a competitive edge through more advanced stats. AWS counts Major League Baseball, the National Football League, the German Bundesliga soccer league, NASCAR and Formula 1 racing among its customers. But how are advanced cloud technology and machine learning helping change how we watch live sports? Read more | | | |

| |  Image Credits: Vichien Petchmai / Getty Images | | To get a temperature check on the state of the travel market, the outlook for fundraising and which sub-sectors might present the most attractive opportunities for startups today, we asked five leading VCs at firms spanning early to growth stages to share what's exciting them most and where they see opportunity in travel, tourism and hospitality tech: - Bonny Simi, JetBlue Technology Ventures

- Pete Flint, NFX

- Tige Savage, Revolution Ventures

- Brad Greiwe, Fifth Wall

- Prashant Fonseka, Tuesday Capital

Read more | | | |

| |  Image Credits: Bryce Durbin / | | It takes guts to be a VC, but being a child actress prepared me well for the challenge. In addition to the serial rejection even the most successful actors experience, life on set isn't always a picnic. The grit and perseverance I first honed on studio soundstages serves me well — and these are also the qualities I look for in the founders I back. Read more | | | |

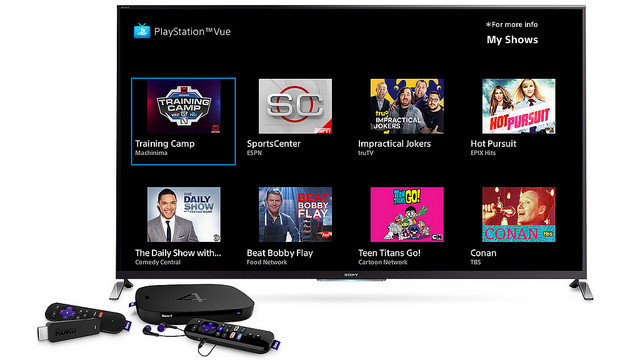

| |  | | On January 30, Sony's PlayStation Vue, one of the first services to offer streaming live TV over the internet, shut down. The service launched in 2015 with live and on-demand content but was quickly eclipsed by other players, even though it was backed by one of the largest brands in entertainment. Reporter Sarah Perez studied Vue’s rocky, brief history to find out what went wrong. Read more | | | |

| |  Image Credits: Paula Dani / Getty Images | | Online marketplaces like Amazon and eBay will command 40% of the global retail market in 2020. As the number of digital offerings — not only marketplaces but also online storefronts and company websites — available to consumers continues to grow, the primary challenge for any online platform lies in setting itself apart. The central question for how to accomplish this: where does differentiation matter most? Read more | | | |

| |  | | Increasingly, the streets of Karachi and Lahore are flooded with men riding bikes and wearing green T-shirts. In a sense, these men represent the emergence of Pakistan's tech startups. Bykea, a three-year-old ride-hailing and delivery service, has more than 500,000 bikes registered on its platform and operates in some of Pakistan's most populated cities, such as Karachi, Lahore and Islamabad, according to founder and CEO Muneeb Maayr. And with less than $7M in VC funding, the startup is beating Uber. Read more | | | |

| |  Image Credits: Bloomberg / Getty Images | | When analyzing the cloud market, there are many ways to look at the numbers; revenue, year-over-year or quarter-over-quarter growth — or lack of it — or market share. Each of these numbers tells a story, but in the cloud market, where aggregate growth remains high and Azure's healthy expansions continues, it's still struggling to gain meaningful ground on AWS's lead. This has to be frustrating to Microsoft CEO Satya Nadella, who has managed to take his company from cloud wannabe to a strong second place in the IaaS/PaaS market, yet still finds his company miles behind the cloud leader. He's done everything right to get his company to this point, but sometimes the math just isn't in your favor. Read more | | | |

| |  Image Credits: Oleg Golovnev/EyeEm / Getty Images | | January 28 was the annual "Hallmark holiday" for cybersecurity, ostensibly a day devoted to promoting data privacy awareness and staying safe online. This year, as in recent years, it has become a launching pad for marketing fluff and promoting privacy practices that don't hold up. Privacy has become a major component of our wider views on security, and it's in sharper focus than ever as we see multiple examples of companies that harvest too much of our data, share it with others, sell it to advertisers and third parties and use it to track our every move so they can squeeze out a few more dollars. Read more | | | |

| |  Image Credits: alvarez / Getty Images | | Hi, I'm Ann. I was one of the first investors in Lyft, Refinery29 and Xamarin. I've been on the Midas List for the past three years and was recently named on The New York Times' list of The Top 20 Venture Capitalists. In 2008, I co-founded Floodgate, one of the first seed-stage VC funds in Silicon Valley. For the past 11 years, I've invested at the inception phase of startups. We've seen startups go wildly right (Lyft, Refinery29, Twitch, Xamarin) and wildly wrong. When I reflect on the failures, the root cause inevitably stems from misconceptions around the nature of product-market fit. Read more | | | |

| |  Image Credits: Lucy von Held / Getty Images | | Shares of One Medical are worth $19.50 this morning after the venture-backed unicorn priced its IPO at $14 per share last night. The company opened at $18 before rising further, according to Yahoo Finance data. At its current price, One Medical is worth about 40% more than its IPO price, a strong debut for the company. The result is a boon for One Medical, which raised $532.1 million during its time as a private company. At $14 per share, the company was worth $1.71 billion. At 19.50, One Medical is worth $2.38 billion, a winning result for a company said to be worth around $1.5 billion as a private company. Read more | | | |

| |  Image Credits: Peter Fischer / Getty Images | | In 2016, Nutanix decided to take the big step of going public. Part of that process was creating a pitch deck and presenting it during its roadshow, a coming-out party when a company goes on tour prior to its IPO and pitches itself to investors of all stripes. It's a huge moment in the life of any company, and after talking to CEO Dheeraj Pandey and CFO Duston Williams, one we better understood. They spoke about how every detail helped define their company and demonstrate its long-term investment value to investors who might not have been entirely familiar with the startup or its technology. Read more | | | |

| |  | | You can't understand what has come to be the power and mystique of tech without also understanding the minds of its enigmatic founders. Justin Kan is a serial entrepreneur and founder who — whether you appreciate his public voice or not — stands out as one of the most interesting examples of that classic Silicon Valley archetype: a tech entrepreneur ostensibly doing much more than just selling technology. Read more | | | |

| |  | | This week, Apple released earnings and gave us hints about the power of its wearables market, Congress began investigating top dating apps and Google’s App Maker announced a shutdown is coming. Plus, the iPad turned 10 and people discussed where it’s going wrong. We also looked at Byte, the so-called Vine reboot. Not only did it launch with a comment spam problem, including pornbots, it’s also filled with adult and sometimes dark humor. This includes videos featuring sex toys, drugs and jokes about child abuse — despite a 12+ age rating and many users who appear to be children. Read more | | | |

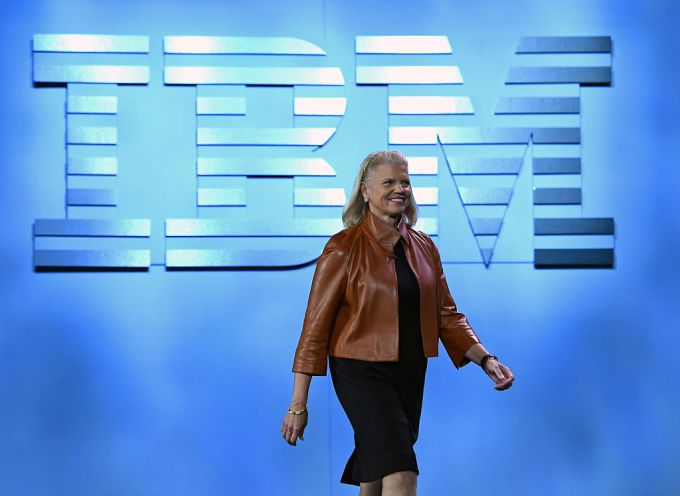

| |  Image Credits: Ethan Miller | | To be fair, Rometty took over at a tumultuous time when technology was shifting from on-prem software stacks to the cloud. She saw what was coming and used the company's considerable cash position to buy what she needed to make that switch while taking advantage of IBM's extensive R&D to build other pieces in-house. But the transition took time, which resulted in some financial missteps. She deserves credit for trying to move the battleship in a new direction — culminating with the $34 billion purchase of Red Hat — even if the results were ultimately mixed. Read more | | | |

| |

| |

| |

| |